As promised, President Trump imposed 25% tariffs on all goods from Mexico and Canada, as well as 10% tariffs on all goods from China. Many economists say these tariffs will hurt the U.S. economy in the short term and raise prices for daily use items. However, long term, these tariffs will force Canada, Mexico, and China to move production facilities to the U.S. enabling a nationwide job / employment spree, as well as mass economic growth.

As reflected by these economists, all day Saturday and most of Sunday, the whole stock market bled. The Dow Jones dropped over 2% as well as all major stocks of American companies. According to Reuters, nearly 500 billion dollars were erased from the stock market over the weekend. However, this dip was an excellent opportunity for investors. Billions of dollars were invested overnight which heavily favored longing stocks. As of Monday, February 3rd, the market has recovered, earning investors a nice amount of money.

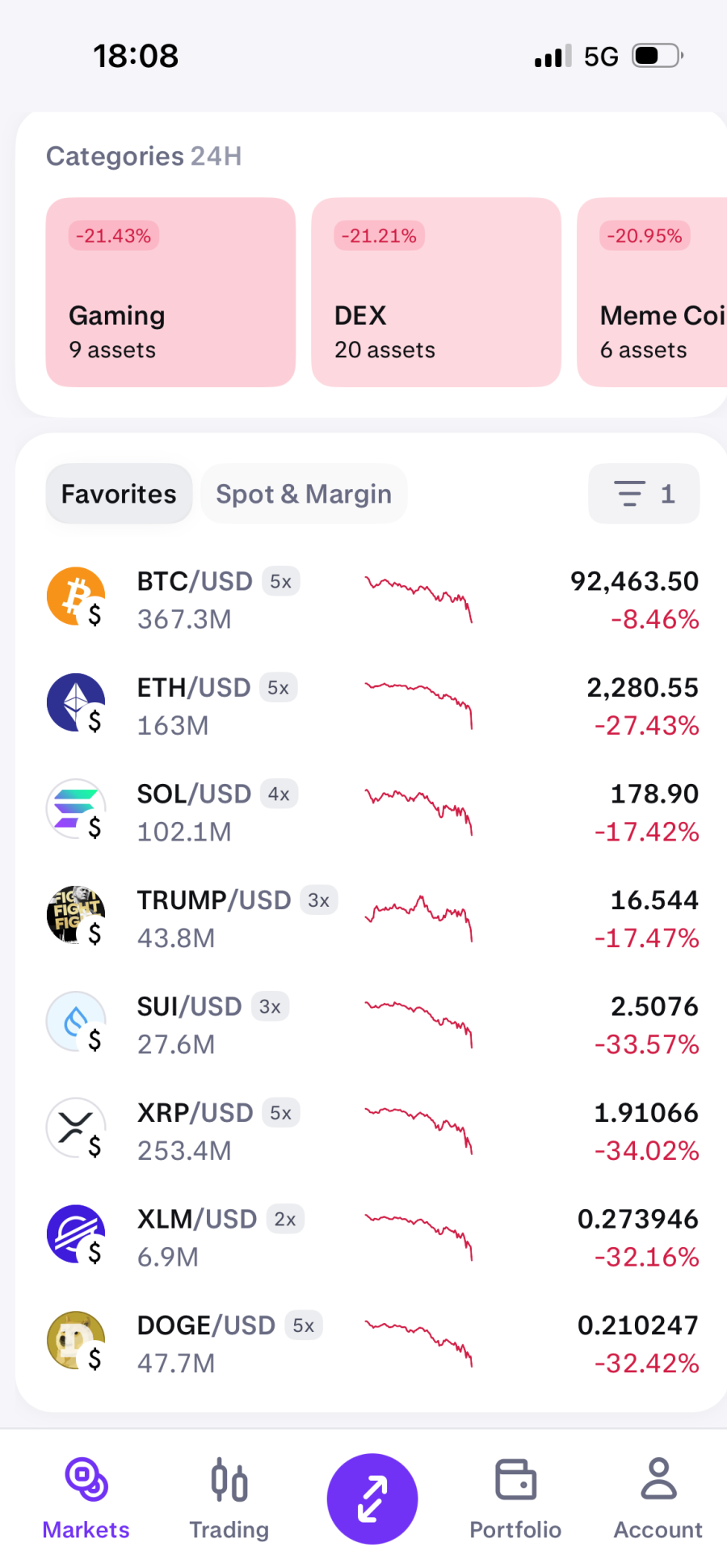

Reflecting the stock market, cryptocurrency also dipped. Maybe dip isn’t the right word. “Jumped-off-the-world’s-largest-cliff-and-fell-through-Earth” would be a more appropriate phrase. As seen in the image, Bitcoin dropped over 8%. But that is nothing compared to the likes of XRP, XLM, SUI, Ethereum, and Dogecoin, dropping 34%, 32%, 33%, 27%, and 32% respectively.  Although money was technically lost, real “crypto-bros” only saw this as an opportunity to buy more tokens. Crypto is known for excessive dips, but people have confidence in it, knowing it will shoot right back up. As of today (Monday, February 3rd), crypto is back up. Not exactly at pre-dip levels, but certainly not as low anymore. Much like stock investors, crypto investors longed for millions of dollars in their preferred tokens this past weekend. That being said, investors probably aren’t too scared of the implications of the Trump tariffs.

Although money was technically lost, real “crypto-bros” only saw this as an opportunity to buy more tokens. Crypto is known for excessive dips, but people have confidence in it, knowing it will shoot right back up. As of today (Monday, February 3rd), crypto is back up. Not exactly at pre-dip levels, but certainly not as low anymore. Much like stock investors, crypto investors longed for millions of dollars in their preferred tokens this past weekend. That being said, investors probably aren’t too scared of the implications of the Trump tariffs.

Days after Trump imposed his tariffs, Mexico and Canada have already agreed with the United States on deals that would see the tariffs delayed for another month. Both Mexico and Canada promised to send 10,000 armed troops to their respective borders with the United States to help stop the inflow of illegal substances, particularly fentanyl, into America. China, however, has said that fentanyl coming into the United States is “not our problem,” even though most of the trafficked fentanyl can be traced to its origin in China. Thus, China claimed that it will respond with its own tariffs on U.S. goods. This could potentially start a trade/ tariff war between two of the most powerful countries in the world. However, tensions could potentially ease during a major summit of the world’s top leaders that is soon to be announced.

Overall, the tariffs that Trump originally announced have been delayed, potentially preventing a total market crash, but have definitely put the United States back into the driver’s seat in global politics. The fear of these tariffs even caused Saudi Arabia to announce their investment of half a trillion dollars into the U.S. economy, with rumors of them potentially pumping that number to one trillion dollars. This is definitely an exciting time to be an investor. With market fluctuations likely to become more common, day trading for beginners will be a lot easier.